If you’ve spent any time researching prop firms, you’ve almost certainly come across Apex Trader Funding. It’s one of the most talked‑about names in futures trading, and for good reason. But popularity doesn’t always equal quality.

So the real question traders will be asking in 2026 is simple: Is Apex Trader Funding actually worth it, or is it just hype?

This review is written from a trader’s perspective. No fluff. No exaggerated promises. Just a clear breakdown of how Apex works, who it’s best for, where traders struggle, and whether it makes sense for you.

What Is Apex Trader Funding?

Apex Trader Funding is a futures prop firm that allows traders to trade firm capital after passing an evaluation. Instead of risking your own large account, you trade under Apex’s rules and keep a percentage of the profits.

Unlike some prop firms that focus on stocks or forex, Apex is futures‑only, which appeals to traders focused on instruments like the ES, NQ, YM, and other CME products.

The appeal is obvious:

No need to fund a large personal account

Defined rules and risk limits

Scalable capital if you perform well

But the structure matters, and that’s where many traders either succeed or fail.

How the Apex Evaluation Works (High‑Level)

To get funded, you must first pass an evaluation account. The evaluation is designed to prove consistency and risk control rather than one lucky trade.

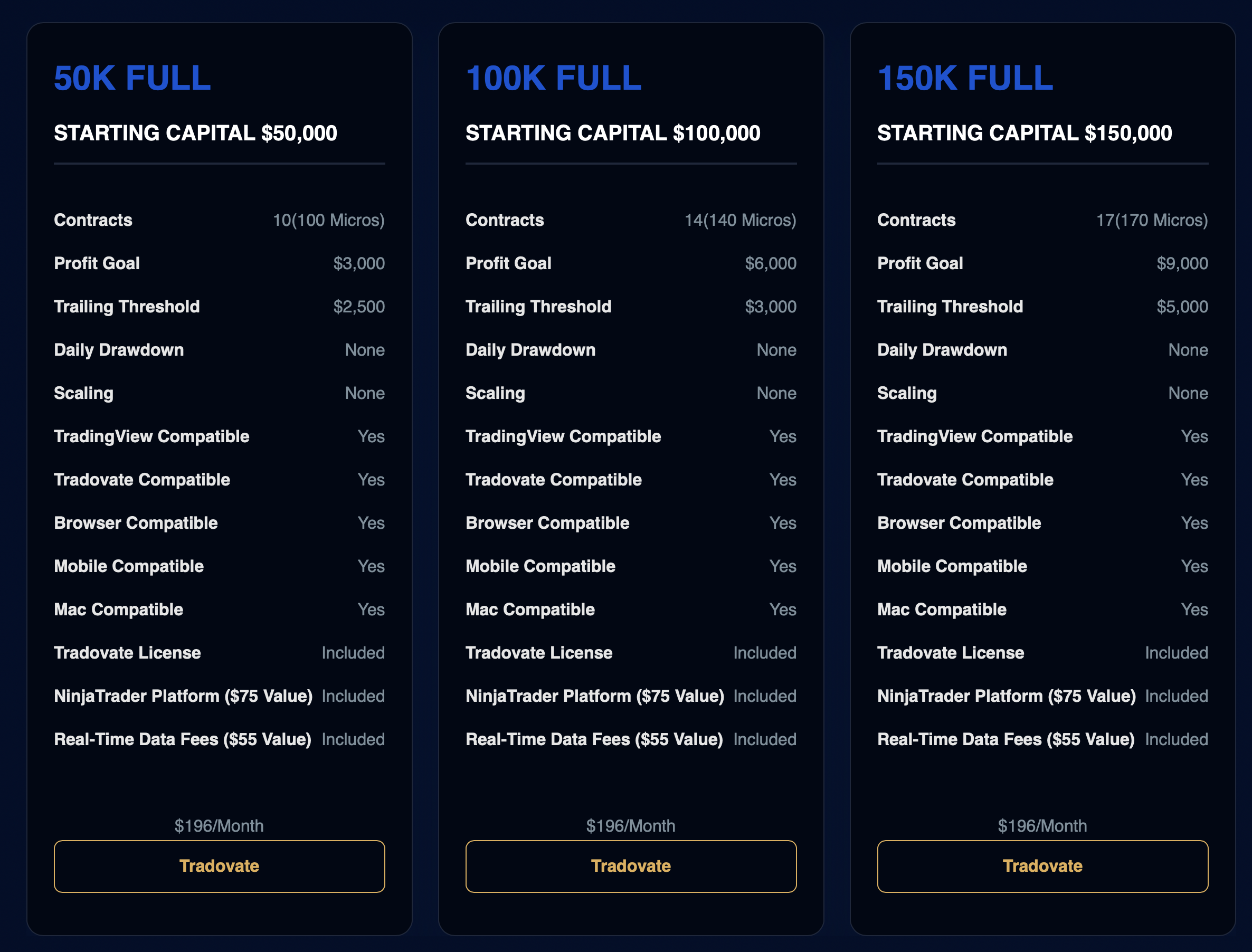

While specific numbers vary by account size, the core structure stays the same:

A profit target you must reach

A trailing drawdown that follows your account

Rules around consistency and discipline

This trailing drawdown is the biggest hurdle for most traders. It rewards slow, controlled growth and punishes oversized trades.

Many traders fail not because they can’t trade, but because they misunderstand how the drawdown moves.

What Happens After You Pass?

Once you pass the evaluation, you’re eligible for a funded account. This is where Apex starts to shine for disciplined traders.

With a funded account:

You trade real firm capital

You’re eligible for payouts

You keep a large portion of profits

Payout eligibility depends on following Apex’s rules and maintaining account health. This isn’t a “get rich quick” setup, but it is a real opportunity for traders who already have an edge.

What Traders Like About Apex Trader Funding

Apex has earned loyalty from many traders, and these are the reasons that come up repeatedly.

1. Futures‑Focused Environment

If you trade futures, Apex feels built for you. The rules, platforms, and structure are clearly designed around futures markets.

2. Scalable Capital

Traders who perform well can scale up over time. This is one of the biggest psychological advantages. You don’t feel capped at a small account forever.

3. Clear, Transparent Rules

While strict, the rules are clearly laid out. There’s no ambiguity about what will disqualify an account.

4. Popularity and Community

Because Apex is so widely used, there’s a large online community discussing strategies, pitfalls, and best practices. That alone reduces the learning curve.

5. Massive Discounts

Apex offers the highest discounts among prop firms, ranging from 80 - 90% off evaluations any given time. You can enter my discount code, BOB, during checkout to get the best discount available that they’re offering.

Where Traders Struggle (And Why Some Quit)

A fair review needs to cover the downsides too.

Trailing Drawdown Pressure

This is the number one complaint. The trailing drawdown forces traders to size down and trade patiently. Aggressive styles almost always fail.

Psychological Difficulty

Knowing one bad trade can violate rules creates pressure. Traders without strict risk management often self‑sabotage.

Not Beginner‑Friendly

If you’re brand new to futures, Apex may feel overwhelming. It’s best suited for traders who already understand order flow, position sizing, and discipline.

Who Apex Trader Funding Is Best For

Apex tends to work best for traders who:

Already have a proven strategy

Understand futures markets

Are comfortable trading small and scaling slowly

Can follow rules without emotional decisions

If you’re still experimenting or gambling, Apex will likely expose those weaknesses quickly.

Is Apex Trader Funding Legit?

This question comes up a lot, and it’s understandable.

Apex Trader Funding is a legitimate prop firm with real traders receiving payouts. That said, legitimacy doesn’t mean guaranteed success. You still need skill and discipline.

Think of Apex as a tool. In the right hands, it can be powerful. In the wrong hands, it’s unforgiving.

Final Verdict: Is Apex Trader Funding Worth It in 2026?

If you’re a disciplined futures trader who respects risk and consistency, Apex Trader Funding can absolutely be worth it.

If you’re hoping for fast money, oversized trades, or rule‑bending, it probably isn’t.

For traders who are ready to treat trading like a business, Apex offers one of the more realistic paths to trading meaningful capital.