One of the biggest reasons traders fail with Apex Trader Funding isn’t lack of skill. It’s misunderstanding the evaluation.

On the surface, the rules look simple. In practice, small misunderstandings compound quickly and blow accounts.

This guide walks through the Apex evaluation exactly how traders experience it, not how it’s marketed. If you’re considering Apex or already in an evaluation, this is the framework you want in your head every trading day.

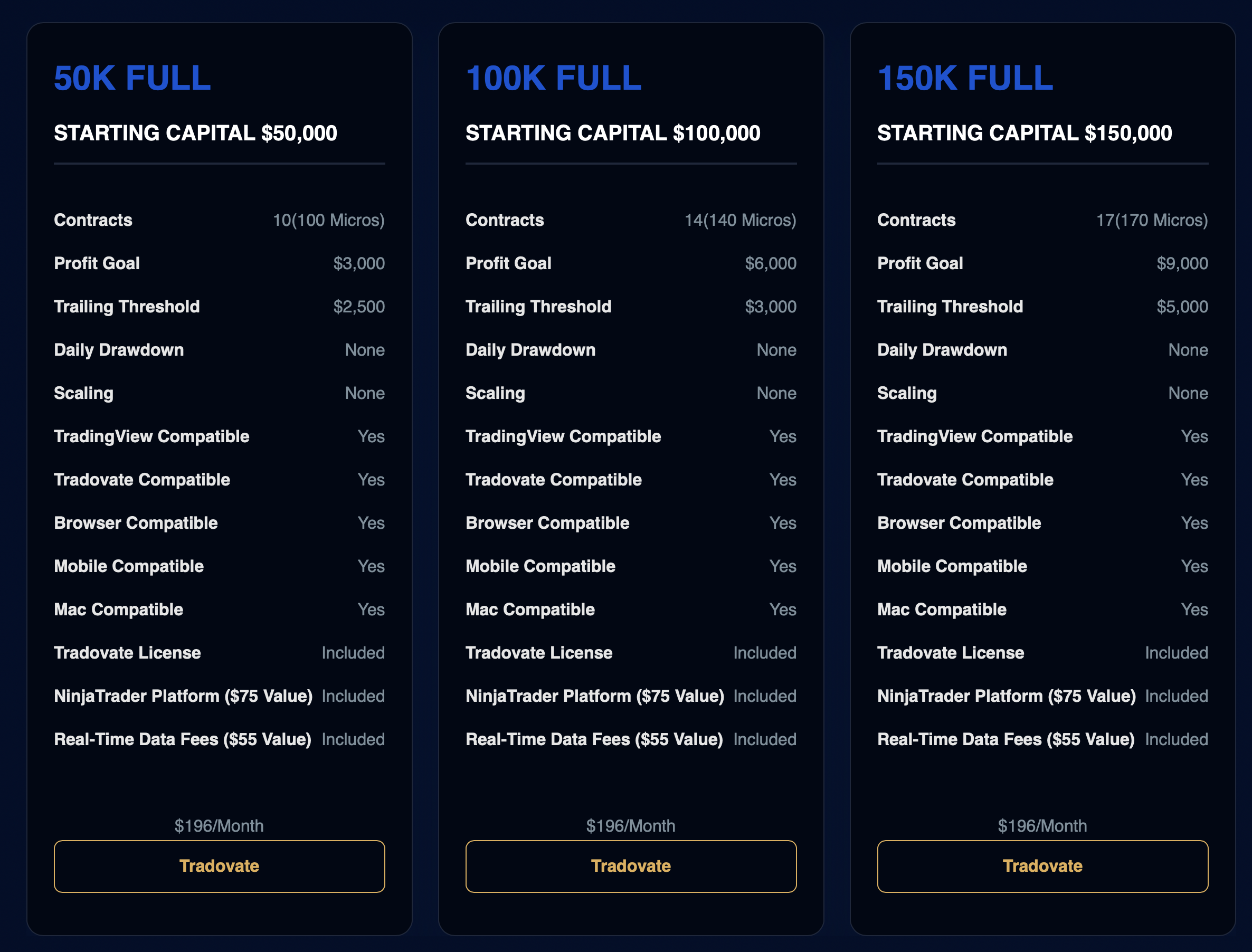

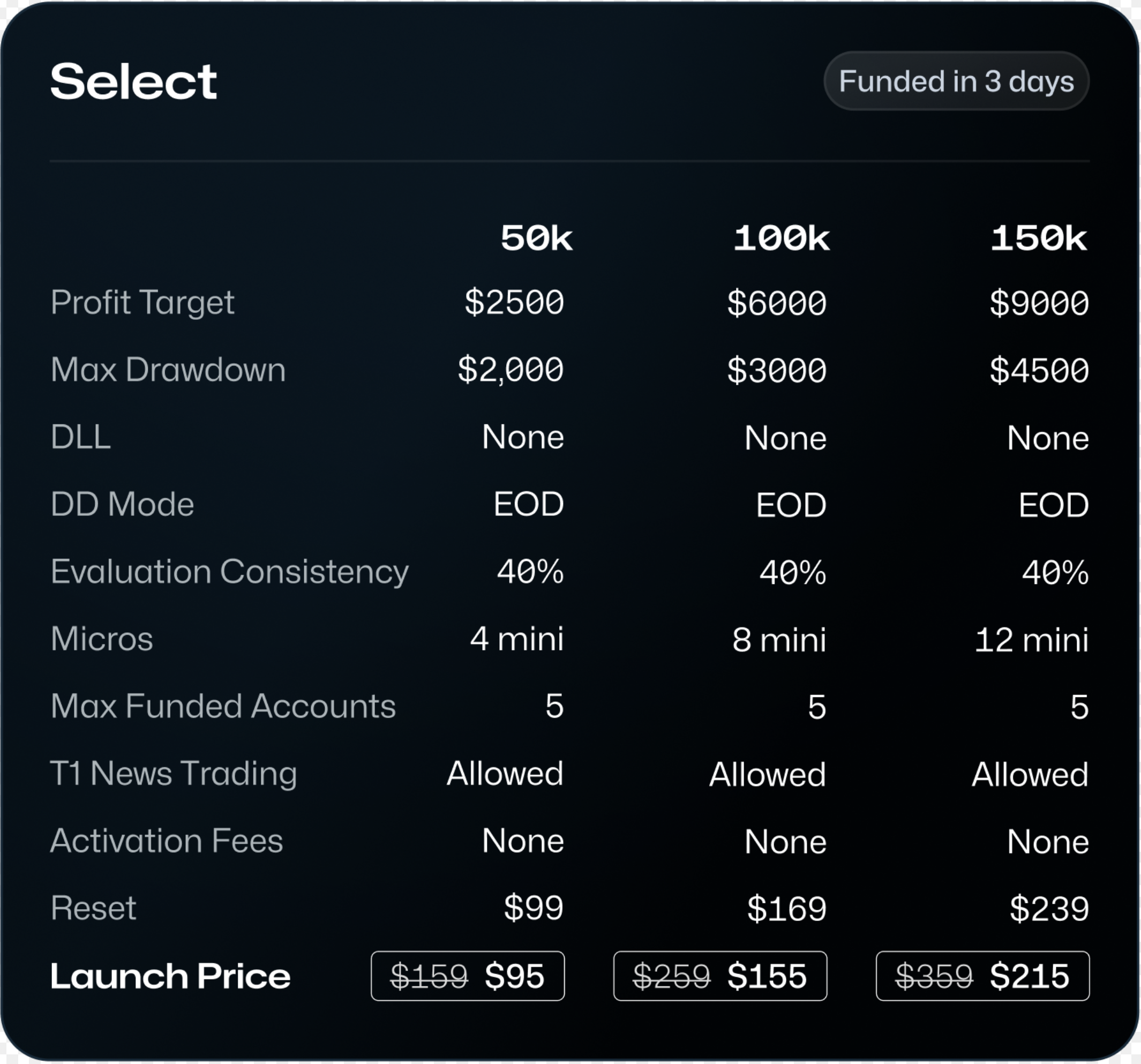

Step 1: Choosing the Right Evaluation Account

Apex offers multiple account sizes. Bigger isn’t always better.

Many traders make the mistake of choosing the largest account available, assuming more room equals more safety. In reality, larger accounts often tempt traders into larger position sizes, which accelerates drawdown violations. Larger accounts also have larger profit targets and therefore a steeper challenge of difficulty.

A smarter approach:

Choose an account size that allows small, repeatable trades

Focus on consistency, not daily profit targets

Treat the evaluation as a process, not a challenge

The goal isn’t to pass fast. It’s to pass clean.

Step 2: Understanding the Profit Target

Every Apex evaluation has a defined profit target. You don’t need to hit it in one day, and trying to usually backfires.

What successful traders do instead:

Aim for modest daily gains

Stack green days

Let the math work over time

The evaluation rewards traders who think in probabilities rather than home runs.

Step 3: The Trailing Drawdown (The Real Test)

This is where most traders fail.

The trailing drawdown moves up as your account balance increases, locking in gains. It does not trail downward during losses. However, keep in mind, Apex uses the unrealized trailing drawdown. Not the popular end-of-day drawdown. This means profits will continue to trail you regardless if you sell or not.

Key implications:

Big early wins can tighten your drawdown fast

Oversized trades reduce margin for error

Slow growth keeps the drawdown manageable

The evaluation isn’t asking “can you make money?” It’s asking “can you protect money?”

Step 4: Daily Risk Management

Successful Apex traders think in maximum loss per day, not maximum gain.

Common rules disciplined traders follow:

Fixed contract size

Daily stop loss

No revenge trades after losses

Most failed evaluations can be traced back to one emotional decision that broke these rules.

Step 5: Consistency Matters More Than Speed

Passing in one day (which Apex allows) sounds impressive. It also raises red flags.

Apex favors traders who show:

Repeated profitable days

Controlled drawdown behavior

Predictable risk

Think like the firm. They’re looking for someone they can trust with capital, not someone chasing adrenaline.

What Happens After You Pass

Once you hit the profit target without violating rules, you become eligible for a funded account.

This is where the pressure often drops. You’ve proven discipline. Now the focus shifts to maintaining account health and qualifying for payouts.

Common Mistakes to Avoid

These mistakes show up repeatedly:

Trading too large too early

Ignoring how the drawdown moves

Trying to force trades to speed things up

Treating the evaluation like a demo

Apex punishes impatience and rewards restraint.

Final Thoughts

The Apex Trader Funding evaluation isn’t impossible. It’s just misunderstood.

If you approach it like a risk management exam instead of a profit challenge, your odds improve dramatically.

Hit the profit target and don’t trigger the drawdown. That’s it. It sound's simple, right? Yet, it can still be challenging.

So be smart and consistent on how to avoid the latter and maximizing your ability to reach the profit target.