If there’s one feature that separates casual chart watchers from consistent traders, it’s alerts.

Alerts let the market come to you instead of you chasing it.

And while TradingView’s free plan gives you just one alert, the Pro and Pro+ plans unlock the tools that serious traders rely on every day.

If you want to test the same premium alert features I use, start here:

Why Alerts Are a Game-Changer

Imagine this scenario:

You’re busy with work, errands, or family.

A trade setup happens exactly as planned.

With alerts, you get notified instantly — you don’t have to sit glued to the screen.

The right alerts:

Save time

Reduce stress

Improve consistency

Prevent emotional or impulsive trades

Paid TradingView plans let you set multiple alerts, customize conditions, and even trigger actions automatically.

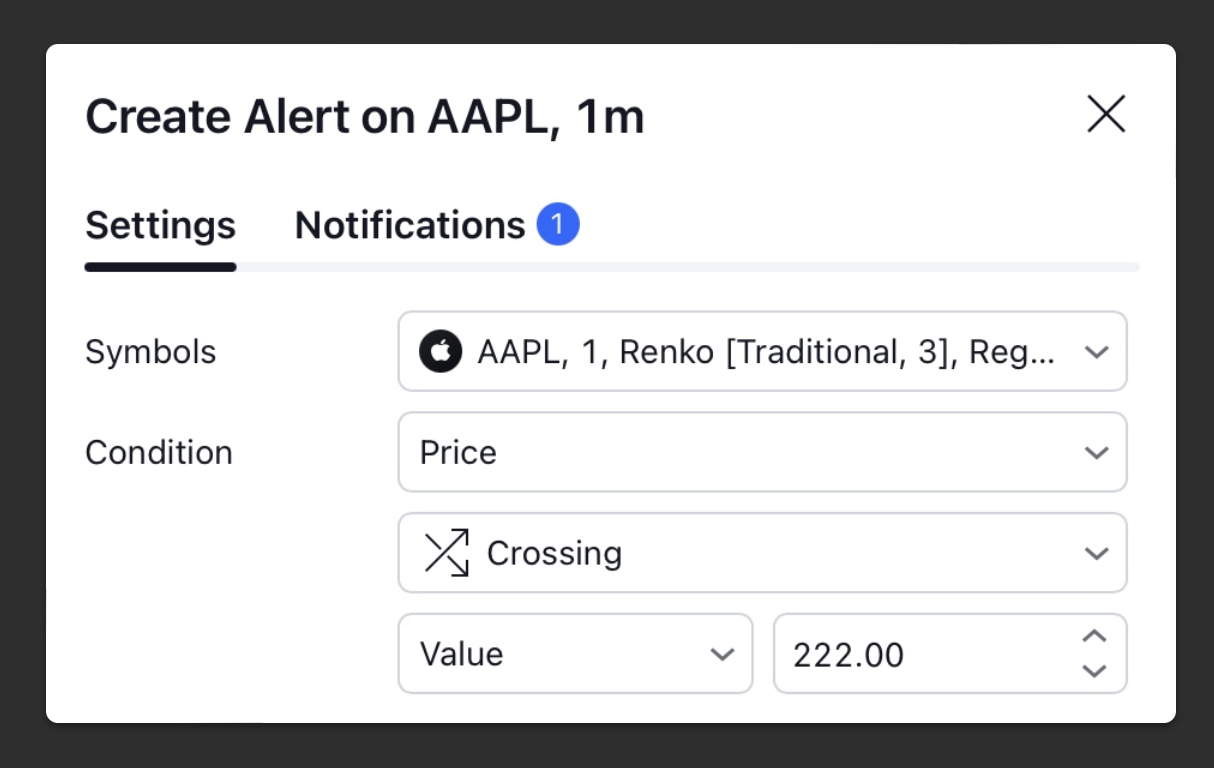

Step 1: Choosing the Right Alert Type

TradingView offers several types of alerts on paid plans:

Price Level Alerts

Triggered when price reaches a specified level

Ideal for support/resistance entries

Indicator Alerts

Triggered when an indicator condition occurs (e.g., EMA cross, RSI oversold)

Saves you from constantly monitoring charts

Drawing Object Alerts

Triggered when price touches a trendline, channel, or horizontal line

Lets you combine technical analysis with notifications

Webhook Alerts

Send a signal to another app or bot

Perfect if you use trading automation or journaling systems

Paid plans let you combine multiple conditions, which can’t be done on the free plan.

Step 2: Best Practices for Setting Alerts

Alerts are only useful if they’re actionable:

Keep them specific – “Notify me if price crosses 1.1200” is better than “Notify me if price moves.”

Use sound notifications or push alerts – email alone can be missed.

Limit the number of alerts – too many, and you’ll ignore them all.

Test them first – a small practice alert ensures they trigger correctly.

Step 3: Alert Strategies That Work

Here are a few strategies I personally rely on:

1. Pullback Entry Alerts

Set an alert at a high-volume node or EMA

Enter when price reacts to the level

2. Breakout Alerts

Monitor consolidation zones

Trigger an alert when price breaks out, not before

3. Multi-Indicator Confirmation

Combine price crossing EMA + RSI threshold

Only alert when both conditions are met

Helps avoid false signals

4. End-of-Day Summary Alerts

Notify you if a stock/crypto closes above or below a certain zone

Helps plan next-day trades efficiently

All of these require at least the Pro plan, which is why upgrading isn’t just convenient — it’s essential for a professional workflow.

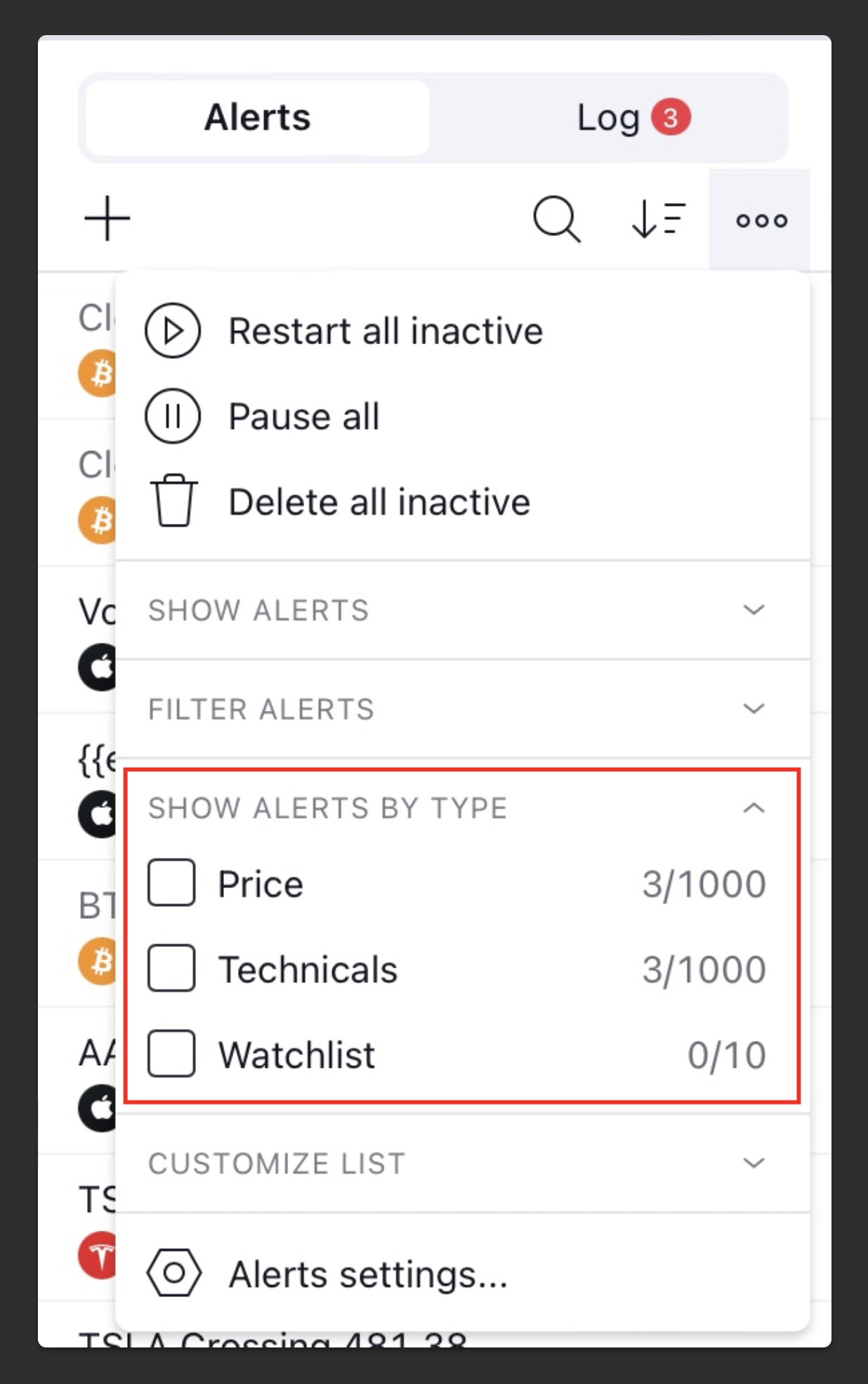

Step 4: Staying Organized With Alerts

Paid plans let you manage multiple alerts simultaneously.

Here’s how I keep them tidy:

Group alerts by strategy or timeframe

Label alerts with clear names (“BTC breakout,” “ES pullback”)

Delete old or irrelevant alerts daily

This ensures you never miss a signal because of clutter.

Step 5: Testing & Adjusting Alerts

No alert system is perfect out of the box.

Backtest alert conditions with Bar Replay

Adjust triggers based on market behavior

Only keep alerts that consistently lead to actionable trades

This process transforms TradingView alerts from a “nice feature” into a trading edge.

Why Upgrading Is Worth It

Free plan: 1 alert → not enough for serious traders

Pro/Pro+: 10–30 alerts, multi-condition setups, indicator alerts

Premium: 400 alerts, webhooks, 8 charts per layout

The ability to catch more trades without babysitting charts is why most traders upgrade.

It’s the single feature that pays for itself if used consistently.

Start Using Alerts Like a Pro

If you want to unlock these features and set up your alert workflow the way I do, here’s the link I started with:

Start catching trades without missing a beat.